The Wells Fargo settlement 2024 is a deal between the bank and the government that is paid to customers who experienced financial wrongdoings at the hands of Wells Fargo. The settlement covers unauthorized accounts, mortgage errors, and improper fees. This settlement is for the good of customers and to win trust with the bank. Do you know about this huge banking settlement? It’s worth learning how it can impact you. Wells Fargo is now trying to address past issues and provide compensation to the customers.

It is the largest settlement in the history of the banking industry. This includes compensation for several financial issues that affected many customers. The eligible person can file a claim and receive his or her amount of compensation.

How Do I Claim My Wells Fargo Settlement?

The most common question every customer has is how to file a claim for the Wells Fargo settlement. Generally speaking, class members qualified to be paid under the Wells Fargo bank settlement 2024 are contacted first. Typically, these communications are delivered via email or formal letter, and even official correspondence which states how to submit claims.

Once you receive word, you are expected to act in accordance with the instructions strictly. This will often call upon you to fill up and submit a claim form-you can do this online, or by mail-and attach proof of your eligibility for the compensation. It pays that all details are correct and updated in good time to prevent delays in the process of claims. Wells Fargo also has a cut-off date for submitting claims which is why swift action is recommended. If you believe you are qualified but do not receive a notice, you can take your claim to the settlement website or contact the customer support for further assistance.

Is Wells Fargo Bank Financially Stable?

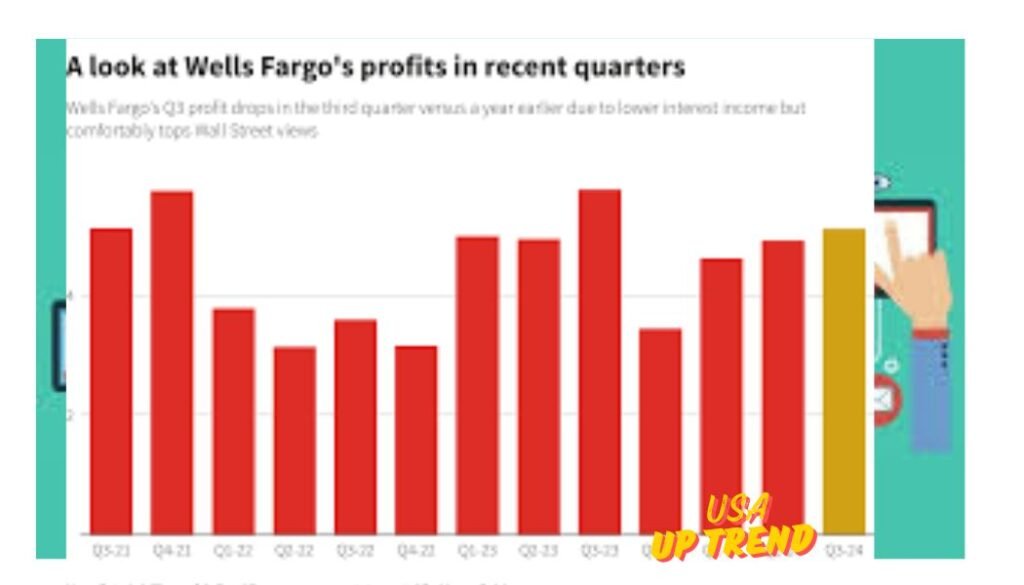

Even after going through all the controversies and judicial litigations, there is a most basic question to be addressed. Does Wells Fargo Bank hold strong financial soundness? It does. Wells Fargo remains one of the biggest banks in the U.S. with a great balance sheet and solid capital. Indeed, the institution did the major restructuring and replacement at the leadership level for reclaiming lost customers, regulators, and investor confidence.

This diversifies financial stability in its business through banking, lending, and investments services. The bank subsequently improved its risk management and compliance capabilities to avoid any future regulatory issues. Though the monetary penalty experienced in the settlements, the massive reserves of Wells Fargo and existing customer base are quite good enough to keep it financially healthy. The bank has indicated steady growth in recent reports of earnings and is still a significant player in the U.S. financial sector.

What is the future growth of Wells Fargo?

Considering the future growth prospects of Wells Fargo, some key pointers suggest that it is perfectly poised for the continued growth. In response to competition from both traditional banks and those that focus only on digital platforms, Wells Fargo has upgraded its digital banking, simplified processes, and even customer services. All this modernization has kept it buoyant in such a competitive marketplace.

It has also been pouring a lot of investment into technology and innovation. With an upgrade in digital platforms and enhanced cybersecurity measures, the bank capitalizes on growing demand for online and mobile banking services. The more customers tend towards digital banks for their financial needs, the more Wells Fargo’s tech-forward approach can help it achieve future growths. Besides, rebuilding trust and enhancing its public image through efforts can attract more stable customer retention and new business opportunities into the bank.

It took over First Union

Wells Fargo has experienced much mergers and acquisitions along the way to transforming a small bank into the behemoth it is today for being one of the biggest and significant financial institutions in the country. Who did Wells Fargo acquire in its history and journey towards expansion? So far, the number of major companies acquired by Wells Fargo as part of its consolidation phase is many, among these is Norwest Corporation was one of its most recent and biggest mergers EVER. The firm took the significant step in 1998 by merging with Norwest, a regional banking giant.

Further, in 2008, Wells Fargo acquired Wachovia at the peak of financial crisis, which turned it to be one of the larger national banks in the US and augmented its sizeable presence in the East Coast. These mergers and acquisitions enabled the bank to broaden its customer base, extend its geography, and widen its market share for an effective challenge against other national banking leaders like JPMorgan Chase and Bank of America.

Legal Consequences and Reforms Post Settlement

Wells Fargo agreed to several reforms under its settlement in 2024 that would prevent further violations and regain consumer trust. This includes internal practice oversight control, strengthening of customer service protocol, and new systems meant to detect fraudulent activity early on. The U.S. Securities and Exchange Commission, along with the Consumer Financial Protection Bureau, monitors such compliance from Wells Fargo to ensure that it upholds the settlement terms.

The settlement also comes with changes in leadership as new executives are put in charge of restoring the integrity of the bank. Wells Fargo has indicated that it is working towards preventing a breach of consumer trust going forward by embracing more transparent and ethical business practices. The progress of the bank in upholding these commitments is a significant area of focus for regulators and stakeholders.

Major Wells Fargo Settlements

| Year | Settlement Description |

| 2016 | Wells Fargo paid $185 million in fines for creating millions of unauthorized accounts without customers’ consent. |

| 2020 | The bank agreed to a $3 billion settlement related to the fake accounts scandal, including $500 million for shareholders. |

| 2024 | Part of the Wells Fargo settlement 2024, the bank agreed to pay $1 billion to resolve claims tied to mortgage and auto loan violations. |

Customer Effects and Payback

It directly affects thousands of customers who have been aggrieved by the malpractices of the bank. Runs the entire gamut of unauthorized opening of accounts, improper charges, and mishandling of loans for which the victims will now be compensate. It includes home mortgages, auto loans, and improper fees charged to customers.

The compensations provided to affected customers by the bank normally consist of fees reimbursed, credits into accounts, or direct cash payments. Settlement also deals with long-run consequences of consumer credit score and financial standing. The above measures provide some sort of relief to the consumers; however, many still remain frustrate about the length of time for claims to be process and the remaining impacts of Wells Fargo’s past acts.

Role of Wells Fargo in the U.S. Banking Sector

Despite all those controversies, Wells Fargo is playing an important role in the United States bank system. Wells Fargo bank settlement 2024 reminded it of the problem that arose, but also helped remind how banks can pass through any legal hurdle or regulatory check. Through its huge number of clients and the many products with which it delivers, which include mortgages, personal loan accounts, and investment account services, Wells Fargo attracts millions of clients from each corner of the globe.

Apart from the usual banking activities, Wells Fargo is also quite active in commercial banking and investment banking. Diversification has allowed the bank to maintain its strong hold in the financial market even during controversies. The long-term success of Wells Fargo in a fast-changing financial landscape will be determine by its efforts at reforming and improving its practices as it moves forward.

Significance of Oversight

Wells Fargo settlement 2024 brings to the fore the importance of oversight in financial institutions ensuring their operational fairness. In fact, both CFPB and SEC have significantly been on the frontline to make Wells Fargo take responsibility for its actions. It is through these regulators that Wells Fargo is ensure compliance with consumer protection laws, there is compensation for affect customers.

More precisely, the Wells Fargo case is an excellent example of what will happen in cases of other banks if these unethical and illegal practices do survive. This is why greater emphasis has been laid upon ethics and compliance with the law. Moreover, as a lesson for the future mistakes, the regulatory authorities are sure to keep a close watch upon the bank and ensure such violations do not recur again so that consumers do not fall a victim to their unfair treatment at its hands.

Conclusion

Settlement with customers is one of the biggest milestones for the bank on its road to overcoming the challenges in the courts and re-establishing its image. Past misdeeds, which will forever scar customers’ memories, open an avenue for compensation and rectification by the bank for affected customers.

With reforms and improvement in services, the bank’s financial stability is robust, as well as its growth prospects in the future. The effort of Wells Fargo to become more technologically innovative and to provide improved customer service and comply with regulatory standards puts the bank on a path towards a brighter, clearer, and more ethical future. Hopefully, past mistakes learned will lead the bank towards a stable and prosperous future.

FAQS

What is the Wells Fargo settlement 2024?

The Wells Fargo settlement 2024 is an agreement by the court which requires Wells Fargo to make a payment to settle any issues related to the bank’s previous financial malpractice. The cases include improper accounts, issues with mortgage, and various overcharge fees.

How do I see if I am eligible for the Wells Fargo settlement 2024?

You would have, if you had suffer at Wells Fargo’s inappropriate practices: a claim for damages; normally, a customer that qualifies will be sent instructions via email or mail how to file your claim;

How do you file a claim for your Wells Fargo settlement 2024?

The settlement will require you to file a claim by following the instructions in the notice received. Claims are normally submit online or by mail and may require supporting documentation for verification of eligibility.

What kind of compensation is available under the Wells Fargo settlement 2024?

The amount of compensation varies depending on the cause. Reimbursement of wrong fees, credit modification, and other forms of direct payment to the consumers may be incorporate. It tries to address the injury brought about in the customers’ financial situation, for instance, through a poor credit rating.

Is Wells Fargo financially sound following the settlement?

Yes, at the settlement, the bank is still financially sound since it has solid capital reserves and continues to provide all banking and investment services to its customers.

What did Wells Fargo wrong in the settlement?

Some of the things that Well Fargo did wrong in their settlement include opening unauthorized accounts contrary to the will of some customers, mishandling mortgage applications, charging the wrong fees, and poorly managing auto loans. Its settlement addresses these issues in addition to compensating various affected customers.

Write more about Business at USA UP TREND