The equity and pay plans are among the best offered in the market. Equity is the amount of shares companies issue as dividends to its employees, and it differs depending on one’s position, role, and experience. The value of employees’ equity is tied to that of the company; therefore, they become interested in prosperity. According to Forbes, how much equity does Spotify give?. Equity is the biggest motivator to come to the company and how equity works at Spotify is also very important, which provides ownership feeling and long-term financial gain.

Equity at Spotify is mostly available in the form of stock options and restricted stock units (RSUs). These equity types are also issued to full-time employees in the form of compensation packages. The amount largely depends upon the seniority of the employee and overall performance of the company as well.

Definition and Importance of Equity Compensation

Equity compensation is essentially when a company grants an employee stock options, or even restricted stock units (RSUs), as part of the pay package. Equity compensation is different from traditional salary compensation, for it provides employees with a stake in the company. This form of compensation has come to be most essential in the tech industry in that it is as much a means of participating in corporate financial success as attaching long-term interests directly to the growth of the company.

For the senior and key employees, equity compensation is evidently a big deal for Spotify’s employment contracts. The reason is simple: buy stock options or RSUs, and Spotify can get all the A-grade people it needs, while throwing at them a guarantee that they will be there for the long ride of a lifetime, because, when the company does well, so do the stocks, and there’s growth, really.

Types of Equity Compensation that Spotify Offers

How Much Equity Does Spotify Give can be conceptualized as one of the two primary forms of equity compensation: options and RSUs. They compensate differentially. Options allow an employee to purchase a specific number of shares in the company at some previously predetermined price, also known as the “strike price,” after a number of years that is called the vesting period. Once the share price of the company increases, the employee will earn money through the purchase of those shares at the lower strike price.

RSUs work a bit differently. They are not providing the right to buy shares; rather, they give employees shares outright after vesting. This kind of equity is least likely to be dangerous for an employee since there is no buying involved; they automatically come into possession once the vesting conditions are met. In this system, all employees benefit in the same proportion irrespective of their financial background when the company does well.

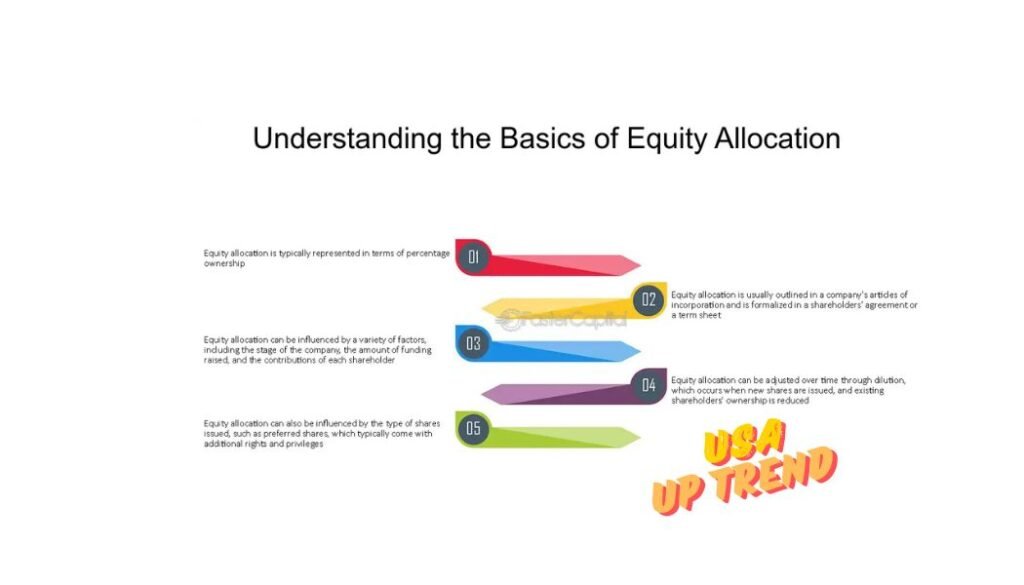

Allocation of Equity Based on Several Factors

The equity allocated to an employee by Spotify depends on several factors such as the position, experience, employee’s seniority, and their location. Normally, entry-level employees are given the lowest amount of equity. Managers and executives have a higher percentage. Stock compensation typically goes to the best performers of a company; most tech companies are the same way.

Equity is often provided as a component of the employee’s overall compensation at Spotify. For example, while an entry-level software engineer may get an allocation of smaller equity, a senior product manager’s equity allocated will be larger. However, every single employee has a shot at having an ownership stake in the company and thus seeing their financial interest aligned with that of the company.

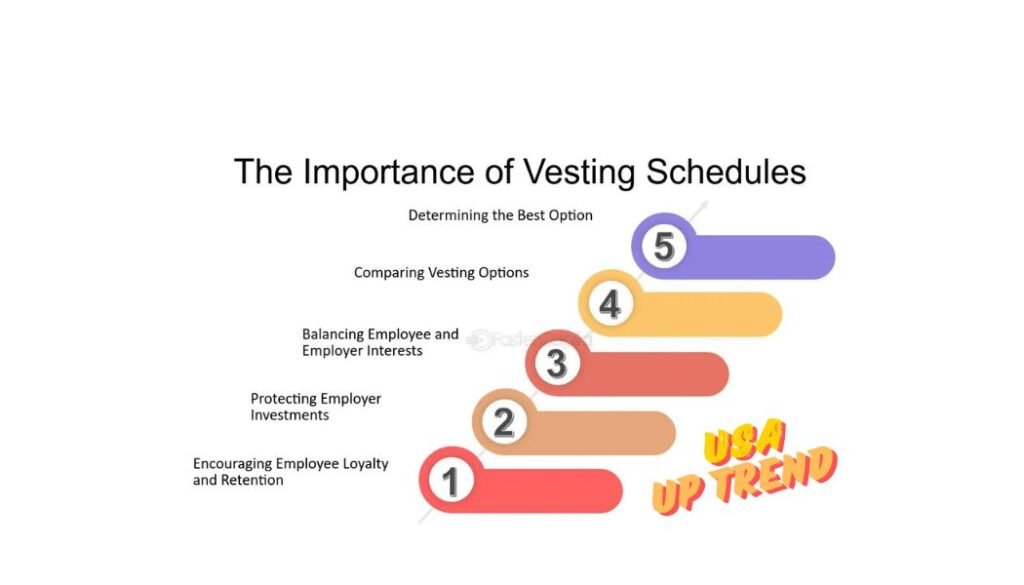

Vesting Schedule at Spotify

The article How Much Equity Does Spotify Give includes the four-year vesting schedule with one-year cliff. Employees will be allowed to have access to only 25% of the granted stock options or RSUs they’ve been awarded, provided they work for at least one year for Spotify. Resting spreads over the following three years monthly or quarterly.

As an example, if an employee is granted 1,000 stock options, 250 may vest during the first year, with the remaining 750 vesting over the next three years. This assists an employee in staying with the company for at least four years to be able to full enjoy their equity compensation.

Employees and Key Executives

Spotify grants equity to almost all staff members, including entry-level and management levels and executives. However, the amount of equity provided depends on how the employee will affect the overall business. Executives are give greater equity since they will play more of a role in determining the future direction of the company. This is the way to keep top talent looking towards long-term solutions.

Almost all roles that could be classify as critical technical or strategic positions-research engineers, scientists, or product managers-are compensate with competitive equity. These are the key position for which Spotify will innovate and keep long-term strategy, making equity such a useful tool in attracting and retaining the best industry talent.

Equity for Contractors and Freelancers

“How Much Equity Does Spotify Give” only makes any sense for full-time employees. Contractors or freelancers hardly have an interest in the company. Contractors work on short-term projects and cannot earn any long-term interest in the company. However, when a contract worker excels over time, this becomes a gateway ticket into a full-time role at which point they could qualify for equity-based compensation.

This observation reveals that Spotify is providing commitment assurance to employees through equity for long-term success in the company. Through delivering equity to full-time employees, Spotify binds its core workforce directly to the financial well-being of the company, therefore creating shared success.

Daniel Ek’s Ownership Stake

It is shown by the co-founder and CEO Daniel Ek, who holds an enormous number of shares in the company. According to reports, Ek owns 8% of Spotify’s total shares, giving him quite a hold on the direction of the company and an immense personal financial stake in it going well. 8% may not seem like a lot as a percentage, but that equals quite a proportion given the valuation of the company in the billions of dollars.

Ek’s ownership interest is decreasing because the firm has issued more shares and thus raised capital over time; however, he remains one of the largest individual shareholders. His leadership and vision form core to the growth of Spotify. Its equity interest indicates long-term commitment in the firm.

Major Shareholders Impact

Apart from Daniel Ek, other large shareholders of the company include venture capital firms and institutional investors who ventured into a early bet on the company. In fact, companies such as Tencent, a Chinese tech giant, own an important equity position in Spotify. These share-owners wield great power over the company’s strategic direction, but through his role as CEO, Daniel Ek remains a driving force behind the company’s growth.

With this, part of Daniel Ek’s ownership has been dilute as a result of increased financing and issuance of shares. Nonetheless, this equity continues to be a highly appealing reason for sticking with guiding the company toward success. Founder-led management and institutional investment have also been essential in sustaining the innovation and expansion that has endured over the years in the global market

Salary, Bonus and Equity Components

Typically, Spotify’s compensation packages include all three elements: base salary, a performance bonus annual, and stock options or RSUs. As such, most employees receive a competitive base salary, an annual performance bonus, and stock options or RSUs. Again, the amount of the different components can vary with individual roles and seniority levels. For example, they may possibly be grant equity at a high portion for executives. While entry-level employees may be subject to a high proportion of base salary.

Equity compensation assumes a crucial importance for fast growing tech companies like Spotify where the stock prices may shoot up very high eventually. To employees, equity is an opportunity to build wealth as the company grows, providing them with benefits they would otherwise not see over time and over their base salary and bonus.

How Equity Assumes Importance in Reaping the Growth Benefits in Spotify

The mix of incentives for Spotify is to align the interest of the employees with the aim of company growth. Adding equity to the pay package ensures employees have a solid financial incentive to contribute to making the company successful. Employees get the increase in the value of stock options or RSUs when Spotify performs well. It has motivated the employees and empowered a culture in them to make a personal investment in long-term growth.

Yet another way the company competes with larger tech firms for top talent is through reliance on equity compensation. Although Spotify can never match the salaries of a Google or an Apple. Its equity packages will be attractive for any employees who believe in the future prospects of the company.

Spotify Equity Overview

| Category | Information |

| Equity Type | Stock options and RSUs |

| Vesting Schedule | Typically four years with a one-year cliff |

| Equity for Executives | Larger deals because of the stronger impact to the company’s overall performance |

| Eligibility | Available to regular, full-time employees; sub-contractors and freelancers are excluded |

Conclusion

The How Much Equity Does Spotify Give article would be a very important part of the firm’s reward package. In which more than money is provided to employees. Equity compensation ensures interest from the employees in seeing Spotify successful for long periods. Thereby making it a very efficient retention tool and motivator for employees. The equity provided is always well within competition against other tech and entertainment companies. Considering the factor of role, seniority, and location. This equity structure is what everyone considering a career at Spotify needs to understand. Therefore, have the majority of the stakes held by CEO Daniel Ek amplifies. The significance place on equity by the company in its strategy. This makes Spotify an attractive company for anyone who wants to be part of the future. That shapes the world of music streaming.

FAQs

What is equity compensation at Spotify?

Equity compensation at Spotify is a no cash benefit grant to employees through stock options or restrict stock units. This helps employees keep the firm’s long-term performance at the top of their list.

How does Spotify treat the equity vesting schedule?

Most employees at Spotify experience a standard vesting schedule. Because they receive a fraction of their stocks over time, which could be up to four years. Vesting schedules may vary for the employee and the role or seniority level.

Who among Spotify can be reward with equity?

All general full-time employees, and particularly those considered technical and managerial, are qualified to receive equity rewards. The cash value and award format may differ according to the factors of seniority and location.

Does Spotify offer stock options or RSUs?

Spotify mainly offers restricted stock units though other cases are also possible with stock options. RSUs are generally prefer for they have less risk. Because they don’t require the employee to buy shares of the company ahead of their vesting.

How does the equity compensation at Spotify compare to others among the tech companies?

Spotify’s equity compensation is certainly competitive with the rest of the tech and entertainment companies. Although it is not as substantial as those of a few of the more established Silicon Valley-based companies. It is something consider very attractive in the music streaming market.

How Much Equity Does Spotify Give?

The foremost forms of equity benefits are stock options and restricted stock units. Though the amount differs by role, seniority, and location. Full-time employees receive all of these forms of equity benefits according to the overall optioned information.

Read more about Technology at USA UP TREND