The term Chari startup valuation refers to a figure that shows the estimated value of Chari, which is an emerging B2B e-commerce platform in Morocco. This valuation includes several factors such as the size of the market and revenue as well as the interest of investors. It is because of this valuation that one will decide the future growth prospect of Chari and invite investments for the future too. Is Chari valuation interesting? With the support of investors and rapid expansion, Chari valuation becomes a hot topic in the startup world. Its unique business model has raised questions among many about the future worth of the company.

Chari’s valuation is a result of leadership, investor support, and market position. Being a company that has registered so much growth, it impacts its valuation directly. Having a focus to revolutionize retail in North Africa, Chari’s valuation has been on the increase.

Chari Ownership

The venture was co-founded in 2020 by Ismael Belkhayat and Sofia El Alaoui Belkhayat, and it very quickly gained recognition by filling in an important gap in the Moroccan retail market. Chari connects retailers-big and small-through its e-commerce platform with suppliers, thus cutting supply chain restrictions and increasing efficiency for thousands of retailers across the country. This innovative approach helped Chari fill a big gap in the typically fragmented industry, thereby becoming an important player in the growing Moroccan digital economy.

Ismael Belkhayat brings consulting and venture building experience that has been largely instrumental to Chari’s brisk growth. His strategic vision is on enabling the company to reach broader areas and escalate its operations in domestic markets as well as neighboring markets. Sofia El Alaoui Belkhayat is the Chief Operating Officer and plays a very important role in overseeing the internal workings of the company and ensuring everything runs smoothly. Leadership in logistics and the securing of partnerships as well as client relations has been very instrumental in the steady growth and appreciation of Chari’s valuation in a crowded startup market.

Who owns Chari

Chari’s e-commerce site was co-founded in 2020 by Ismael Belkhayat and Sofia El Alaoui Belkhayat and quickly gained popularity thereafter by filling an important gap within the Moroccan retail market. It connects small and medium-sized businesses with suppliers, streamlining the supply chain and bringing about more efficiency for the retailers everywhere in the country. This innovative approach has enabled Chari to bridge a massive gap in an industry that, for so long had been fragmented, making it a key player in the burgeoning digital economy of Morocco.

With Ismael Belkhayat, consulting, and venture building brought charter to help the exponential growth of Chari. He owns strategic vision with regard to the reach expansion and scaling operations within domestic markets and in neighboring territories. Sofia El Alaoui Belkhayat is the Chief Operating Officer who bears the responsibility for day-to-day management of operations to make sure that everything runs smoothly within the company. Logistical, partnership, and customer relations leadership under her has been crucial for the continued success and rising Chari startup valuation in this competitive landscape.

A good startup valuation is, therefore, based upon its stage of development, revenue, market size, among other factors. In other words, the good valuation of a startup is both its current performance and the growth.

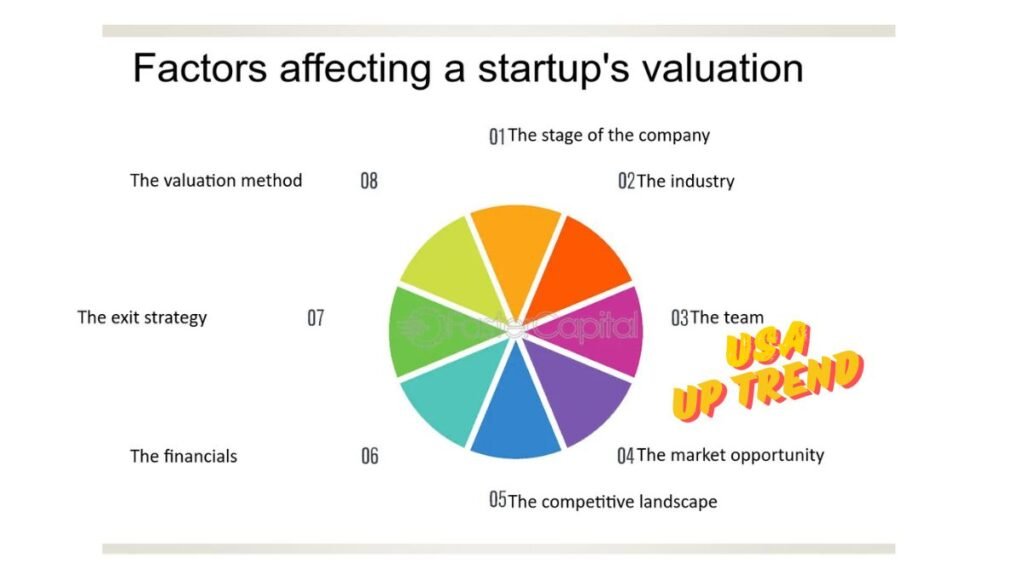

Factors Affecting Good Valuation for a Startup

A multitude of factors goes into determining an amenable valuation for a startup. These involve the level of demand within the market, revenue potential, the competitive landscape, and the strength of the founding team. Each factors into how investors imagine the value of a startup and whether they are likely to invest, and what kinds of offers they will give in return for investment.

An understanding of these influences can help founders position their companies in better ways to attract investment and get better valuations.

Market Size

The size of the market in which a start-up operates heavily influences the valuation. Start-ups based in large or highgrowth markets command a more significant valuation since they pose abundant opportunity for scale. Chari, for instance, is focusing on the retail sector in Morocco; that’s an enormous market with immense growth potential. This has such a massive market size, making Chari even more attractive to investors besides leaving the company perfectly positioned for more scaling into the near future. As the requirements for digital solutions in the retail space are shooting up, sound valuation will be a great beneficiary of this for Chari.

Revenue and Traction

Revenue streams and traction in the market are typically strongly related to the valuation of a startup. Investors will be looking for signs of a solid business model and a verified and consistent revenue generation capability. Chari has taken great strides in closing the gap for local retailers through enhancing efficiency in supply chains. By enhancing its customers strongly and by clearly portraying the growth toward profitability, Chari is driving valuation up. The tangible growth metrics that the company demonstrated guarantee investors and hence it is a very presentable proposition in B2B e-commerce.

Investors

It also brings much prestige to the valuation process, more so because the involvement of famous venture capitalists significantly enhances a startup’s valuation. As reputable investors back up a company, it sends the right signals about being confident in the potential behind the startup into the market. Chari attracted local as well as international investors, thus raising much-needed capital, but more importantly, doing so improved its credibility in the eyes of the other would-be investors. Such investment inflow is all the more needed to hike the overall valuation of Chari, as it does reflect strong market interest in the company and its growth trajectory.

Competitive Advantage

With the intention of getting better valuations, having a competitive advantage is the most essential aspect for a startup. It can be a unique business model innovative in solving the problem or sound supplier relationships. In Chari’s case, its B2B e-commerce model has facilitated a better connection between the retailer and supplier; it can improve the operational efficiency while enhancing service delivery. This competitive advantage, aside from warding off investors’ attention, contributes to the better valuations obtained; the uniqueness of Chari’s offer places it in a privileged position in the market. Capitalizing on these strengths, Chari could continue to differentiate itself to the benefit of both customers and investors.

| Stage | Round Valuation | Examples of Important Achievements |

| Seed | $500,000 – $2 million | Idea stage, minimal traction |

| Seed Stage | $2 million – $10 million | Launches first product, start to gain some early customers |

| Series A | $10 million – $30 million | Product/Market Fit achieved; revenue-growing stream |

| Series B and Beyond | $30 million – $100 million and above | Scaling dramatically, market leadership, high revenues |

Taking all this into account, the of the Chari startup valuation would be seed or early Series A because of the traction found in Morocco and a plan to expand its business in the rest of North Africa.

Who Are the Investors in Chari Morocco

Any startup cannot have a purely organic growth trajectory without the importance of local and international investors; Chari has gracefully attracted an impressive array of both domestic and international backers. Beyond financial resources, this amazing rooster of investors does offer the strategic guidance and industry expertise necessary to navigate the market complexity curve. This investment allows Chari to refine its business model, enhance operational efficiencies, and scale the business more aggressively. In addition, such investors typically have significant networks that can open doors to fresh collaborations and opportunities, thereby further strengthening Chari’s market presence. As such, an investment by these great souls propels a scalable and very competent valuation for the Chari startup in the stormy landscapes of the competitive e-commerce sector.

Chari Key Investors

The key investors in Chari have a significant stake in the company mainly due to their strategic acceptance in the presentation of Chari and its immense business potential in transforming the Moroccan retail landscape.

Y Combinator

The global accelerators for startups are also involved in Chari’s early growth stages. The support from such an esteemed program provides great backing as investors do receive an indication that Chari can really shine through in the competitive market.

The association with such a program lends credibility not only to the start-up but opens doors to many more opportunities of investment. Thereafter, Chari was able to gather massive revenues through such a major source with Y Combinator to achieve the desired niche in the global market. This has played a big role in informing the company’s strategy and energizing its growth, thereby further improving its overall valuation in the eyes of potential stakeholders.

Orange Ventures

The investment arm of telecom giant Orange has taken an investment in Chari, showing much confidence in the future prospects of the startup to transform the retail sector in Morocco. This strategic partnership will not only give Chari essential back-up in terms of finances but also leverage the vast resources and expertise of one of the world’s greatest telecommunications providers with Orange Ventures, Chari gains access to both the latest technologies and market insights that are well supplemented by huge networks to augment its operational capabilities.

This puts Chari in even better position to grow and innovate as the company is able to more promptly respond to the challenges and seize emerging opportunities within this fast-developing retail space. Orange Ventures investment really makes Chari even more believable besides increasing its valuation, making it a very interesting prospect from other investors.

Plug and Play

Chari has also drawn the attention of Andela, a renowned innovation platform situated in Silicon Valley. This deal cements another milestone for Chari and shall be very significant to the company more than just financial injections into the startup. It offers entry and access to the gigantic global network of mentors and industry players into which Chari will find its way through this deal.

By collaborating with Plug and Play, Chari will be able to tap the enormous amount of knowledge and experience that the platform harbors, gaining better insights into moulding business plans and expanding its business further. With such a platform having an abundance of resources and connections within the tech ecosystem, Chari is ready to dive deeper into new lines of innovation, expand its market reach, and stay updated about the latest trends in the market.

Outlierz Venture

A venture capital firm based out of Morocco, it has been known to be one of the main proponents of Chari while it is leading the digitalization of the retail supply chain in the region.

Outlierz focuses its investment in funding African startups with growth potential. Chari provides the much-needed access to capital while bringing industry expertise and strategic advice to undergird this startup. Outlierz would then look to upend retail in Morocco, making it more efficient and connected. As Chari continues expanding its operations, the investment by Outlierz Ventures is playing an important role in making it a leader in the digital retail space and raises its overall valuation. Kima Ventures Kima Ventures is another prominent investor who has a diversified global portfolio of investments that focuses primarily on early-stage startups.

Involvement with Chari is much needed on various grounds. First, the funding will provide Chari with much needed capital. Second, it will translate to legality in the purpose and operations of the startup .

Kima Ventures

It is known to have supported innovative ventures to great heights, creating confidence in investors that this must be a venture with great potential for growth and success. In this competitive landscape, the strategic positioning is bound to favorably position Chari startup valuation for an upward adjustment. As Chari gathers steam, the Kima Ventures seal of approval stamps credibility to it and makes it one of the most promising propositions for potential investors.

Valuation enhancement due to Investor Funding

The funding from such prominent investors lend significant credibility to Chari, thereby contributing immensely to its valuation too. Such persons do not simply serve as funding, but their names and contacts are also filled with a class and glamour. For startups like Chari, such funding will help it bring in more chances of receiving attention and interest from a few more potential investors. Now, with endorsements such as these companies, Chari will be able to effectively utilize these connections for highly valued funding through subsequent rounds. Long-term investor support puts Chari into prime market positioning and justifies all the prospects of growth, thus making the venture more attractive to those interested in investing in such an exciting e-commerce sector for Morocco.

What Is the Formula for Chari Startup Valuation

The valuation of a startup is, in effect an art science – combining a blend of finance metrics, market potential, and the subsequent investor sentiment. There do exist viable methods to determine the valuation of a startup, but these will have different benefits depending on the developmental level of the business. Early startups will rely more on growth prospects and market opportunity, while a more developed company would tend to rely on historical financial performance and cash flow analysis. In this section, we discuss a few of the most widely used formulas for determining valuations of early-stage companies and see through which methods investors and founders evaluate the business value at various stages of the company’s life.

Chari’s Market Potential and Growth

Chari’s market potential and growth possibilities are some of the critical valuation determinants of the company as a whole. The B2B e-commerce segment remains relatively underdeveloped in North Africa; the growth and innovation opportunity there is highly prospective. Its value will dramatically increase as Chari scales its operations and continues to look into other African markets outside Morocco. Investments in the African tech system are rife, which makes this an attractive opportunity for investors. With the proper approaches currently in place, Chari is very well-positions to leverage the rising demand for online retailing solutions, making it a very exciting player in the region’s constantly shifting market landscape.

| Valuation Element | Description | Impact on Chari Startup Valuation |

| Revenue Growth | High retail market growth | Creates investor confidence; therefore, high valuation |

| Investor Support | Key investors- Y Combinator and Orange | Increases investor credibility; hence, has a potential of valuation |

| Market Size | Undertapped Retail Sector in Morocco, etc. | There is potential space to grow as a factor supporting higher valuations |

| Leadership Team | Experienced founders with appropriate networks | Increases attraction to investors; therefore, valuation goes high |

| Technology | Proprietary B2B platform enhances the retail supply chain | A premise to be compensated through a better valuation compared to competitors. |

Conclusion

The future prospects for the valuation of the startup appear auspicious, for with an innovative business model, a robust team of founders, and leading investors to back the company. Moreover, as Chari continues to expand into retail in Morocco and then more extensively across North Africa, its valuation will likely continue to go higher. So, indeed, whether in the form of another funding round or expansion into other regions, the value of Chari is bound to increase because it secures a strong position within Africa’s tech ecosystem.

For potential investors and stakeholders interested in supporting a promising startup with vast potential, Chari puts forward a strong case. With time, the Chari startup valuation will indeed change as the latter continues to play its role in the transformation of retail in Morocco.

FAQs

What factors determine Chari’s startup valuation?

Several factors determine Chari’s startup valuation. They include the market size, revenue potential, traction, investor support, and competitive advantage. The valuations are likely to be higher when the market is bigger or if the proven revenue streams are involve. When reputable investors are involve, their credibility may enhance and attract more funding likely.

Why does the potential of Chari’s market determine its valuation?

Chari operates in Morocco’s retail sector, which is very big and relatively untapped; thus, it provides immense growth opportunities. Growing demand for digital solutions in retail increases the expansion potential for Chari, making it an attractive option for investors looking to enter this space.

Who are the key investors in Chari?

Chari has attracted both local and international investors; among them, the big venture capital firms like Y Combinator, Orange Ventures, and Kima Ventures. These have helped not just in terms of financial muscle but also because of the credibility added to Chari’s mission, thus a positive impact on the overall valuation.

What percentage role does revenue and traction play in the valuation of Chari?

Revenue and traction can be said to be the two most important elements for valuation for Chari. The business continues to see steady growth in revenue and customer base, which renews investors’ confidence in the business model. While Chari is to continue acting as a bridge for local retailers, the success of gaining healthy traction will work only in favor of higher valuation by prospective investors.

Read more about Technology at USA UP TREND